- READ MORE: The average U.S. credit score DROPS for the first time in ten years

Credit scores are a crucial aspect of overall financial well-being.

However, these scores — which determine our eligibility for crucial financial services like mortgages, auto loans, and credit cards — are similarly marred by inaccuracies.

Credit scores are measured from 300 to 850. Anything below 629 is considered 'bad', while Anything over 720 is considered 'excellent'. as stated by the credit scoring firm FICO.

A poor score could result in increased interest rates on loans And even being considered unworthy of products like mortgages.

Here finance expert Monique White, head of community at Self Financial - This service assists Americans in enhancing their credit scores - debunks the five most significant credit score misconceptions and provides ways to steer clear of them.

1. Reviewing your personal credit report can negatively impact your score.

Knowing where you stand is key to financial success and checking your credit report is one way to get an overall view of your finances.

Many people believe that checking your own credit report will drop your score.

While you should be cautious of credit checks that count as hard inquiries, whenever you look at your own report it’s counted as a soft inquiry, which has no impact on your score.

You can obtain your credit report without charge at annualcreditreport.com.

2. Leaving a balance on your credit card will help increase your score

It’s commonly believed that maintaining a small balance on your credit card will help you build your score.

However, carrying a balance on your card from month to month can accrue interest fees.

A rule of thumb for revolving debt is to keep your balances below 30 percent of your available credit.

But it’s best practice to pay off your balance in full each month so you can avoid fees and to keep your utilization low.

3. You only have one credit score

The three primary credit-reporting agencies are Experian, Equifax, and TransUnion.

Various bureaus might possess distinct information regarding your credit activities (such as accounts and collection records), leading to potential discrepancies in the scores they provide.

Although FICO and VantageScore are the predominant credit scoring models, various iterations and sector-tailored credit scores may lead to differing results based on the lender and the specific type of credit you’re seeking.

4. The amount of money you earn affects your credit score.

Even though your earnings might affect your eligibility for specific loan offerings, they do not play a role in determining your credit score.

Your score is determined by five elements: your payment history, how much credit you're using, the duration of your credit history, newly acquired credit, and the variety of credits available to you.

5. Upon getting married, you will jointly have a single credit score with your partner.

Getting married doesn't merge your credit scores automatically.

Everyone will maintain an individual score that reflects their personal financial background.

If a couple decides to share financial responsibilities by opening shared credit cards, co-signing loans, or adding each other as authorized users, these actions will affect both of their credit reports.

So it’s important to keep that in mind when making combined financial decisions.

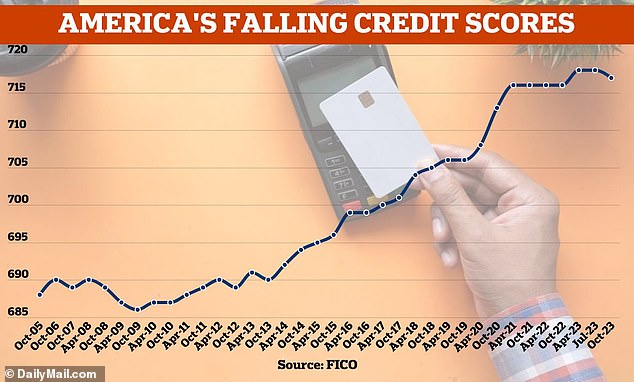

The urgent advice comes as Americans' credit scores fall for the first time in a decade thanks to record high prices and elevated interest rates pushing more Americans further into debt.

The national average credit score fell to 717 from a record high of 718 at the beginning of last year, according to FICO.

Over the last ten years, every time the average score was reported it either increased or remained steady - rising from 690 in October 2013 to 718 last April.

Nevertheless, an additional specialist previously stated last year busted another big myth , all you need is a solid score, not a flawless one.

Once your score reaches 740, you're deemed to have an excellent credit rating for credit cards, car loans, and various non-mortgage financial products, says Ted Rossman, senior industry analyst. Bankrate .

"For mortgage purposes, I'd set the cutoff at 780," he stated. Ainoti .

After that stage, I would surely keep up with the positive practices that contribute to a solid credit score, yet I wouldn’t stress over achieving flawlessness.

He stated that achieving a higher score doesn't offer any real advantages; instead, it merely gives you something to boast about.

Read more

EmoticonEmoticon